|

||

|

Silent Member

加入日期: Nov 2013

文章: 0

|

Following recent seasonal patterns, the next couple of quarters for Apple are likely to be challenging, though we would use weakness to accumulate positions in front of iPhone 6 and new category rumors.

- William Power with R.W. Baird Apple策略定調利潤優先,寧割地、不賠款。然成長引擎將因此失速,早就是華爾街對Apple前景的疑慮。在新的增長動力出現之前,Apple績效應無太大驚喜。後續的情境將是減收減益。 Apple's results indicate a "trade-off" that the company isn't willing to sacrifice margins for market share growth. However, "What are Apple's growth opportunities at the price point where they are at?" Apple's March 2014 guidance strengthens the idea of Apple as a stock to own through product cycles, given that the maturity and size of its core markets will make it difficult for new products to meaningfully re-accelerate revenue growth. - Gene Munster at Piper Jaffray Apple’s forecast for the current quarter also raised questions as the numbers offer a glimpse of how sales are faring after the release earlier this month of the iPhone on China Mobile. Apple projected evenue in the current period may fallr from a year earlier, in what would be the first quarterly sales decline since 2003. Last fiscal year, Apple posted its first profit drop in more than a decade. 好酒沉甕底,iPhone的中移動效應本季看得到,年底前會徹底發酵。不過中聯通、中電信之前沒4G,iPhone不是也賣的嚇嚇叫? The full impact of the China Mobile deal may take time as the carrier extends its 4G wireless service from an initial 16 markets to 300 by year-end. - Tim Cook, Apple's CEO Why the deal with China Mobile didn’t seem to be propelling sales as much as expected ?The deal would, indeed, “have a positive impact on our iPhone sales this quarter.”For example, sales into NTT Docomo last quarter had boosted Apple’s smartphone share in Japan to 69%. - Peter Oppenheimer, Apple's CFO 27日美東時間下午四點,Apple股價微升0.81%至$550.50;一小時後Apple線上法說會開始;法說會後,Apple盤後交易迄晚間八點已重挫8.08%,跌$44.46,以$506.04作收。   Apple now has an installed base of about 280 million iPhone users, with replacement purchases representing about 74 percent of that mix, of which the curse side is because the high-end smartphone market appears to be topping out with mid-range smartphones posting the most growth. - Rob Cihra of Evercore Partners Apple continues to target the market for high-end phones, even as demand accelerates for lower-cost models, particularly in emerging markets. But Apple is resisting the urge to release a truly low-cost phone that could crimp profitability. Apple's remarkable run of earnings growth came to a halt in the past fiscal year as the company's annual profit fell for the first time in more than a decade. 即使世道低價為王,很酷的Cook挑明,Apple宗旨在精不在多。 Our objective has always been to make the best, not the most. - Tim Cook, Apple's CEO 由於電信商改便補貼政策以保持獲利,Cook坦承iPhone在北美銷量首次下滑(難怪稍早前的Verizon財報突然不公布銷量數字)。 Revenue in the Americas region fell 1 percent to $20.1 billion. Sales in North America were weaker than the company expected, partly because the less-expensive iPhone 5c released last year wasn’t as popular as the higher-end iPhone 5s. Apple didn’t have the right mix of iPhones for sale between the 5s and 5c models, and the high-end 5s was more popular than expected. Apple also attributed the drop in part to new upgrade policies by carriers that led customers to wait longer to upgrade their devices. The issue for Apple's December quarter iPhone sales was not international markets. Rather, the shortfall stemmed from lower than expected sales in the U.S. Apple attributed part of the domestic shortfall to a change in carrier upgrade policies, which stretched the iPhone upgrade cycle among owners of the iPhone. - Charlie Wolf of Needham & Company The fact that carriers are becoming more strict to 24-month upgrade cycles could serve as a sign that the "balance of power" between wireless providers and smartphone makers is shifting back to carriers. - Maynard Um with Wells Fargo 成長遲緩,Apple若無法再造iPod、iPhone、iPad這種創新旋風,僅持續現行的更新與升級策略,投資人未來恐不買單。 The stagnating growth is adding pressure for the company to release new hit products, be it a wearable computer or a way for paying for things with an iPhone or a television. Apple hasn’t introduced an entirely new product since the iPad’s debut in 2010. The iPhone was released in 2007. Absent that, the company has been counting on updates to those existing product lines to fuel demand. The company released the iPhone 5s and 5c, as well as the iPad Air and iPad mini in time for the holiday shopping season last year. It's "more clear than ever" that Apple needs to introduce an entirely new product to return to the kinds of growth trends the company previously saw. - Brian White of Cantor Fitzgerald To expect the kind of growth we saw years ago is not feasible. These are more expensive products, especially what Apple is selling, and that condenses the market opportunities. - Channing Smith at Capital Advisors Inc. What we have gotten over the last year or so is impressive products, but they are really enhancements of current products and not necessarily the next new thing. Apple investors want the next new thing -- that’s the catalyst that people are waiting for. - Jack Ablin, chief investment officer with BMO Private Bank If you look at the last earnings release, the iPod is disappearing. People worry that the iPhone is going to disappear, mainly for the same reason, that there’s tremendous competition. And the iPad, which is a brilliant product, is also coming up against tremendous competition. So while the company is going to earn money for a long period of time, and is terrific, I think Carl Icahn’s remark is right, I just don’t think without Steve Jobs there’s that next great thing. I think Google has the guys that create the next great thing. - Donald Drapkin, founder of Casablanca Capital Beyond the lack of iPhone growth, investors are also concerned about "lack of product innovation". Potential share price upside catalysts could come in the form of capital allocation, growth from China Mobile, new product cycles, and potential new revenue streams from new product categories. - Amit Daryanani at RBC Capital Markets This quarter we expect Mac unit sales to increase 4% y/y to 4.1 million on a refreshed product lineup, a larger distribution network and positive Apple ecosystem effects. We are forecasting iPhone sales of 39 million units, 2 million above last year on strength from Japan and China. We continue to view China as very important to Apple and the deal with China Mobile as a long term positive. We expect sales at China Mobile to be less pronounced in the near term but expect the carrier to act as a long term tailwind as the carrier continues to build out its 4G services to additional cities. We have lowered our iPad unit sales targets as we were too aggressive in the previous quarter despite the addition of the new iPad Air and iPad mini. We believe near term risks are significant due to the potential iPhone product cycle upgrade which could negatively impact gross margins. (Higher costs associated with larger screens etc.) Longer term we see less risk due to the recurring nature of the iPhone business. We also believe Apple will offer additional software and services that could offset hardware gross margin declines. Examples of these markets include mobile payments, advertising, content packages, video game sales etc. - Stephen Turner with Hilliard Lyons Is the growth of sales of Apple’s iOS-based devices slowing?No, it’s about in line with the recent past. Our math suggests F1H14 iOS (iPhone + iPad) sell-out growth of 10% Y/Y, in-line with the 11% growth in F2H13 after adjusting for channel inventory and an estimated 4-5M impact from elongated US carrier upgrade cycles. If CEO Tim Cook’s acknowledgement of a new product category launch in 2014 isn’t evidence enough, a meaningful step up in R&D expense (similar to 2000 pre-iPod, 2006 pre-iPhone, and 2008 pre-iPad), and the clear discontinuation of the iPod line (to make room for new categories, in our view) provides confirmation. So, while we’d rather see a business that is accelerating (vs. the flat iOS growth we highlight above), transparency into meaningful product launches should help re-accelerate growth in C2H14. - Katy Huberty at Morgan Stanley When Apple launched the new iPhone 5c in September, we were disappointed that the company wasn’t more aggressive with pricing. This was partly mitigated by stronger demand for the 5s, but on the conference call, the company noted that “It was the first time we had ever run that particular play before, and the demand percentage turned out to be different than we thought. We obviously always look at our results and conclude what to change moving forward, and if we decide it’s in our best interest to make a change, then we’ll make one. Obviously I’m not going to predict price changes on the earnings call. We believe Apple has the ability to lower the price of the iPhone to compete more aggressively in the midrange, and we believe the resulting elasticity would yield net profit improvements from such a move (despite a lower gross margin). We believe the company’s commentary and the performance for the 5c over the holiday quarter makes this more likely. - Bill Shope of Goldman Sachs  Apple's gross margin was 37.9% in the December quarter—higher than the company's estimate range of 36.5% to 37.5%, and compared with 38.6% in the year-ago period. For the March quarter, Apple forecast a gross margin of 37% to 38%. Strong sales of the iPhone 5s and its high price points helped push gross margins higher than expected in December. My concerns for Apple go beyond the current March quarter and into June. I'm modeling June quarter revenue to decline by more than 16 percent quarter over quarter, which would exceed the average decline of 15 percent seen in the company's previous two June quarters. - Keith Bachman of BMO Capital Markets 高階智機熱潮衰減已是不爭的市場趨勢。Samsung跟LG同處困境。 Apple isn't the only smartphone maker feeling the pinch from tighter competition. Last week, Samsung Electronics Co., Apple's main rival in the smartphone market, said profit at its mobile arm fell in the December quarter due to an increase in marketing expenses to promote new models. LG Electronics Inc. said its mobile business swung to a loss in the December quarter, hit by price competition and growing marketing expenses. The high-end of the market is saturated. Apple’s going to have to rethink its approach. - Van Baker at Gartner Strategy Analytics表示,兩大龍頭雖難以撼動,但主場優勢遷移,在新興國家,二線廠商與一票中國品牌,比以往更具競爭力。 Samsung and Apple together accounted for almost half of all smartphones shipped worldwide in 2013. Large marketing budgets, extensive distribution channels and attractive product portfolios have enabled Samsung and Apple to maintain their grip on the smartphone industry. There is clearly now more competition coming from the second-tier smartphone brands. Huawei, LG and Lenovo each grew their smartphone shipments around two times faster than the global industry average and captured a combined 14 percent market share. • Huawei is expanding swiftly in Europe, • LG’s Optimus range is proving popular in Latin America, • Lenovo’s Android models are selling at competitive price-points across China. Samsung and Apple will need to fight hard to hold off these and other hungry challengers during 2014. Apple remains strong in the high-end smartphone segment, but a lack of presence in the low-end category is costing it lost volumes in fast-growing emerging markets such as India. - Strategy Analytics 不過酷哥認為Apple在新興市場的表現還是很酷的。 We have seen sharp unit growth in various markets, such as growth of 76% in Latin America, 65% in the Middle East, 115% in Central and Eastern Europe, and 20% in Greater China. - Tim Cook, Apple's CEO IDC立場亦呼應SA的觀點。 Apple posted record shipment volume during 4Q13, driven primarily by the addition of multiple countries offering the iPhone 5S and 5C, and sustained demand from its initial markets that saw these models launch at the end of 3Q13. It remains to be seen how much Apple will close the gap against Samsung in 2014. - IDC • Even with its success, Huawei faces a crowded group of potential competitors within striking distance. • Despite having no presence in North America nor Western Europe, Lenovo finished the quarter in the number four position. Its strength lies in the strong presence within key emerging markets and a well-segmented product portfolio spanning from simple, affordable smartphones to full-featured 5" screen models. Should the company become successful at branching into more developed markets in 2014, it could challenge Huawei for the number three spot. • LG finished just behind Lenovo and edged out ZTE for the number five position, with just five million units separating the two companies. At the same time, its year-on-year improvement put the company on par with Huawei and Lenovo with market beating growth. LG's success can be directly attributed to its revived portfolio from a year ago, which featured more large-screen and high-end models, including the Nexus 5 and its Optimus G series. - IDC Among the top trends driving smartphone growth are large screen devices and low cost. Of the two, low cost is the key difference maker. Cheap devices are not the attractive segment that normally grabs headlines, but IDC data shows this is the portion of the market that is driving volume. Markets like China and India are quickly moving toward a point where sub-$150 smartphones are the majority of shipments, bringing a solid computing experience to the hands of many. - Ryan Reith, Program Director with IDC's Worldwide Quarterly Mobile Phone Tracker |

|||||||

|

|

|

Silent Member

加入日期: Nov 2013

文章: 0

|

虧損無法擋?Google新春優惠價,賤賣旗下手機事業部Motorola,以後摩托靠Lenovo來拉。

This move will enable Google to devote our energy to driving innovation across the Android ecosystem, for the benefit of smartphone users everywhere. As a side note, this does not signal a larger shift for our other hardware efforts. The dynamics and maturity of the wearable and home markets, for example, are very different from that of the mobile industry. We’re excited by the opportunities to build amazing new products for users within these emerging ecosystems. 大動作收購IBM X86伺服器部門後,甚囂塵上已久的Lenovo手機收購案,最終選擇了Motorola,而非被點名的HTC! The acquisition, worth at least $2 billion, will include more than 10,000 mobile communications patents currently held by the United States company. 當初Google可是花了125意鎂,才拿下Motorola的。 Google acquired the company and its then 17,000-strong patent portfolio, along with 7,500 filed patents, in August of 2011 for roughly $12.5 billion. The deal will make Lenovo the world’s 3rd largest smartphone vendor, surpassing China’s Hauwei, with about 6% market share. Huawei had 5.7% share in Q4. - Neil Mawston of Strategy Analytics 此文章於 2014-01-30 09:21 AM 被 weiter5494 編輯. |

||

|

|

|

Silent Member

加入日期: Nov 2013

文章: 0

|

Motorola Mobility is currently the #3 Android smartphone manufacturer in the U.S. and #3 manufacturer overall in Latin America.

拉美不就是LG的重點市場? Google終究是為了專利才收購Motorola的。 Google will maintain ownership of the vast majority of the Motorola Mobility patent portfolio, including current patent applications and invention disclosures. As part of its ongoing relationship with Google, Lenovo will receive a license to this rich portfolio of patents and other intellectual property. Additionally Lenovo will receive over 2,000 patent assets, as well as the Motorola Mobility brand and trademark portfolio.  Android陣營第二大手機廠Huawei,近日已在專利訴訟案上向Apple、Microsoft陣營繳錢認輸。同列全球前五大手機廠在內的Lenovo雖未列被告,但此時完成Motorola的收購,進軍國際之際的防衛意味濃厚。   |

|

|

|

Silent Member

加入日期: Nov 2013

文章: 0

|

研調數據先後揭露上季平板銷量。

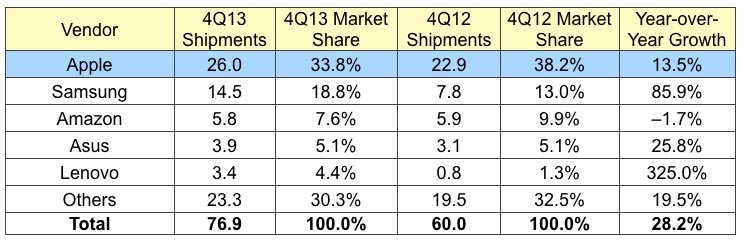

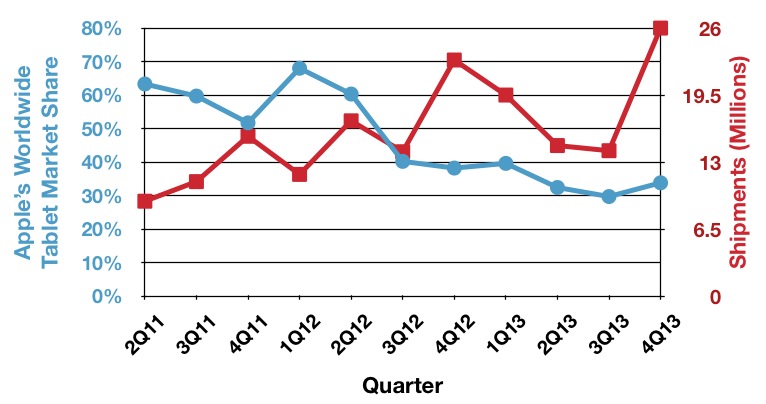

Source: Digitimes Digitimes在Apple財報日前發佈的報告,與Apple官方數據有別。  Source: IDC IDC指出,全球2013年平板出貨量2.171億台,相較2012年的1.442億台,年增50.6%!已開發市場趨近高度飽和,縱使新興市場成長快速,仍拉低去年第四季的成長率。 It's becoming increasingly clear that markets such as the U.S. are reaching high levels of consumer saturation and while emerging markets continue to show strong growth this has not been enough to sustain the dramatic worldwide growth rates of years past. We expect commercial purchases of tablets to continue to accelerate in mature markets, but softness in the consumer segment—brought about by high penetration rates and increased competition for the consumer dollar—point to a more challenging environment for tablets in 2014 and beyond. - Tom Mainelli, Research Director, Tablets, at IDC Lenovo成長三倍,IDC看好後市。 Lenovo’s access to the Chinese whitebox manufacturing infrastructure has helped it drive more low-priced tablet products into the market, growing its share from just 1.3% in the same quarter last year. The company's strength in emerging markets, and its increased market share in adjoining markets such as PCs and smartphones, makes it well positioned to see additional tablet gains in 2014. - Jitesh Ubrani, Research Analyst, Worldwide Quarterly Tablet Tracker@IDC. Apple仍舊保持龍頭地位,然增長力道已大幅落後市場與其它對手,拱手讓出王座,指日可待。  While the quarter represented Apple's most successful on record, its year-over-year growth of 13.5% was well below the industry average.  |

|

|

|

Silent Member

加入日期: Nov 2013

文章: 0

|

昔日Acer棄將,今朝Lenovo悍將的蘭奇,官運亨通,不過受器重者仍在PC產品跟歐洲銷售通路。無論如何,幹到COO一職,也算他的能力,

Lenovo四月起,組織變革,自Lenovo跟Think兩大品牌事業部打散,依產品重新劃分為四大新事業群(Business Group)。 • PC - Desktop及NB,由Gianfranco Lanci領軍,升執行副總與兼任COO! • Mobile - smartphone、tablet、TV,由劉軍領軍,升執行副總。 • Enterprise Computing - server、storage,由Gerry Smith領軍,升執行副總,兼管美洲區銷售。 • Ecosystem and Cloud Services - Lenovo軟體生態系統與雲端服務,由即將卸任CTO的賀志強領軍。 前線銷售區域小幅更動。 • EMEA、 MAP - 由COO、PCBG主管Gianfranco Lanci負責。 • Greater China、EAP - 由資深副總陳旭東負責。 • Americas - 由ECBG主管Gerry Smith負責。 MAP:Mature APac,包括日本與紐澳。 EAP:Emerging APac,除MAP外的亞太區。 CTO由現任Think品牌事業部主管Peter Hortensius接任。 CFO黃偉明續任,升執行副總。 |

|

|

|

Silent Member

加入日期: Nov 2013

文章: 0

|

引用:

引用:

引用:

引用:

就在德國Mannheim地院宣判HTC侵權Nokia在歐的EP1679613專利,HTC接著昭告將上訴該專利的無效確認,並即刻修改自家手機設計的一周後,HTC正式宣佈付款向Nokia授權取得專利技術。   從企業經營的角度來看,宏達電的團隊至少在技術跟法務上知己知彼的能力是完全不及格,嚴重浪費公司資源,損害股東權益。從買S3來跟蘋果互告,到回擊Nokia的連環控訴,宏達電面對訴訟警爭對手,高估自身底氣,一昧頑抗,打沒勝算的訟戰,最終依然賠款了事,充分彰顯高層的顢頇無知,遑論在現時的激烈競爭中翻身獲利,但也讓外界了解其自詡創新的內涵,其實是不食人間煙火的盲目。 精彩回顧: 諾基亞發動全球專利戰:以45項專利告宏達電、優派、RIM 2012/05/03 可攜式電子通訊裝置專利訴訟Nokia控告HTC侵權 2013/08/29 宏達電與諾基亞侵權官司,在宏達電支付權利金後,宣告終結,一年多前,宏達電也以同樣的方式,與蘋果握手言和,「賠錢了事」戲碼反覆上演,讓人擔心的是,宏達電還有沒有專利競爭力?宏達電與諾基亞、蘋果「和解」戲碼如出一轍,專利侵權官司爭點在於「權利金」,因此這幾場官司看似「和平收場」,但宏達電一再「賠錢了事」其實已是輸家;除了近幾年專利訴訟失利,宏達電的產品創新度也備受挑戰。 - 聯合報觀察站 其實該問的是宏達電『究竟』有沒有專利競爭力,面對通訊巨頭挑戰時的自保能力。因為事實上Google幫不了,Qualcomm也保不了。 這廂Nokia對HTC再度取勝,那廂同樣是昔日通訊巨頭的Motorola在歐洲對決Apple卻落敗。 人所皆知,怕熱就不要進廚房。智機這廚房究竟有多熱?以下是HTC仍列案被告的專利訟案,Amen! • 手機通信專利訴訟,Mobile Enhancement Solutions LLC控告HTC、Apple及Motorola專利侵權 2012/03/26 • Touchscreen Gestures以陞達的觸控IC技術控告HTC、三星、蘋果等手機大廠侵權 2012/04/13 • 語音控制專利訴訟,專利授權公司Potter Voice指控HTC等26家手機與軟體大廠 2012/04/30 • 數據儲存專利訴訟,E-CONTACT 控告Acer、HTC、Sony Ericsson等七間公司 2012/07/19 • 手機通訊頻道專利侵權Cellport Systems控告三星、HTC等多家手機大廠 2013/02/05 • Tela Innovations對HTC等手機大廠提起337調查及IC專利侵權訴訟 2013/02/18 • 智慧型手機專利訴訟Wireless Mobile Devices LLC控告HTC及美國通訊業者與通路商 2013/05/27 • 行動裝置之app付款認證方法專利訴訟Smartflash控告HTC及Samsung 2013/06/04 • 通訊交換系統專利訴訟PatentMarks控告HTC等科技大廠 2013/06/10 • 來電轉接專利訴訟Bluebonnet控告HTC、Apple等12家大廠侵權 2013/06/25 • 無線通訊專利訴訟Cellular Communications Equipment控告HTC等大廠侵權 2013/07/03 • 無線通訊產品專利訴訟Wi-Lan控告HTC及Verizon Wireless 2013/07/11 • 影像處理專利訴訟 FlashPoint 控告 HTC侵權 2013/08/19 • 影像結合通訊裝置專利訴訟 Cellect LLC控告HTC侵權 2013/10/01 • 網路影像傳輸裝置專利訴訟 Alex Is The Best控告Amazon、Asus、HTC、LG與Sony 2013/10/24 • 數位音訊播放器專利訴訟 Advanced Audio Devices控告HTC 2013/11/01 • Rockstar Consortium控告Google及Android陣營廠商 2013/11/04 • 智慧型手機晶片專利訴訟Vantage Point Technology控告Acer、Asus、HTC等公司 2013/11/11 • 移動通訊服務管理技術專利訴訟 Securenova控告HTC 2013/11/11 • 游標顯示裝置專利訴訟 Long Corner控告Acer、HTC等18家公司 2013/12/11 • 近場通訊專利訴訟 法國政府設立France Brevets在美分公司NFC Technology控告HTC和LG 2013/12/13 |

||||

|

|

|

Silent Member

加入日期: Nov 2013

文章: 0

|

引用:

本季營運目標(NT$): Revenue:340~360億元, GM:21.5~22%、季增約4個百分點, OM:-4.9~-6.4%、季減, Income:虧損17.8~21.9億元,相當於每股虧損2.1~2.6元。 法說會,法人六問HTC,三問無奈: • 首季財測:遠遜市場預期。 • Nokia和解權利金:保密原則,無可奉告。 • 未來新機進度:籌劃中。 Nokia payments, more fearsome than Apple case: HTC has announced to make payments to Nokia in a technology collaboration agreement. Neither party has disclosed further details. According to JPM analyst Sandeep Deshpande, the back-calculation from Apple’s royalty payments to Nokia seems to suggest a 0.5-0.7% royalty payment, which has included cross licensing; if we "unroll" the cross licensing, it could be close to 1%. Nokia’s conversion into a pure IP company means it is probably not so interested in cross licensing anymore. We suspect HTC will fall into the “unrolled” case, and estimate HTC will have to pay about 0.7-1% of sales to Nokia for future business. Nokia might likely go after the other Android vendors as well, still the competitive landscape means it is difficult to pass on the extra costs to consumers. - JP Morgan 歷經連續27個月的營收年減,HTC依然信心滿滿,自認本季將是營運谷底,之後季季向上,重返榮耀。 The problem with us last year was we only concentrated on our flagship. We missed a huge chunk of the mid-tier market. - Cher Wang, co-founder and Chairwoman of HTC We needs to sell more mid-tier and affordable smartphones after losing out in 2013. New mid-tier and low-end handsets should provide the majority of revenue, bar sales from its flagship HTC One phone, after the first quarter. HTC will sell products in the $150 to $300 retail price range for both emerging and developed markets, along with high-end phones which can sell for over $600. [IMG]HTC won't get into the "very, very low-end market[/IMG]." - Chialin Chang, CFO and Global sales president of HTC HTC將在中國大陸推出人民幣1500至3000元作為主力產品,也會銷售人民幣1000元的低價手機。中低價產品線與價格均到位,連中國電信業者也認為宏達電終於「踩對線了」。這些基於Mediatek方案的機種全數委外ODM,中階四核機由台系華寶,低階雙核機由陸系龍旗、聞泰操刀。  宏達電財務長張嘉臨 錯過了這個村,就沒有那個店。曾經堅決不碰千元機,中國商機在2013年與HTC擦身而過,今年再回頭晚矣。總是跟不上市場節拍的決策敏感度,HTC won't get into the "very, very low-end market."將會是running-out-of-time的HTC再蹉跎的一年嗎? Of the 53 phones for sale on HTC's China website, only two models cost less than $150 - the highest-growth price bracket in China, while twenty-one are over $500. Local smartphone maker Huawei Technologies Co Ltd lists eight models under the magic $150 threshold. And Xiaomi's phones sell for between $130 and $410. - IDC 今年的千元機將是4G浪潮,而3G入門機種將可能是五百元俱樂部(八核大屏機本機已進八百元價格帶)。小米模式震憾中國,電商手機再引領智機探底風潮。戰鼓高擂,中國一線大廠、個性化品牌紛紛驚蟄,�**藿鶣嶊瑣y族黃章走向台前,華為榮耀爭當陣頭,中國智機市場二次洗牌戰正式開演。除了爭低,中國品牌不忘登高,Xiaomi跟ZTE已正式向Sharp下單IGZO面板,中高階將再起新高規低價殺戮。   低價真無能獲利?以低價機起家的中華酷聯,忝為中國四大金剛,銷量皆已超過3000萬支門檻,除Coolpad外,其餘皆難以從其合併財報中一觀損益。Coolpad與HTC同為單純的手機終端品牌商,自2011年起,乘低價智機浪潮,穩建經營,成長快速。營益率雖低,卻始終獲利,2013年上半淨利率幾為HTC的兩倍,而營費率僅有HTC的一半。營收約HTC的三分之一,獲利已達HTC的六成。 |

|

|

|

|

Silent Member

加入日期: Nov 2013

文章: 0

|

Wearables?Are you kidding me, HTC?

Releasing a wearable could be a diversion into an unproven market at a time when focus has never been more crucial. The company’s comments feel at once like a hedge against the possibility that Apple may release a watch in 2014 — a rumor second in persistence only to the Apple TV idea — and also like an attempt to prove it can keep up with its Android rivals Samsung and LG. Samsung blanketed airwaves and billboard with Gear ads, and one can expect the same treatment with a Galaxy Gear 2 device — something HTC would be hard-pressed to counter. LG has a deep bench of products and a history of manufacturing everything from robot vacuums to washer-dryer sets to TVs to phones. 宏達電現在需要的是專注力,此刻見獵心喜未必討喜。  HTC需考量中階機款是價格和獲利壓力最大的產品線,而高端機款在美國電信商改變補貼策略下也有壓力,雖然HTC目前現金水位約530億元,且HTC傾向保留營運資金,股利政策將調整,對今明年展望不樂觀,預警每股將分別虧損6.74元、 12.17元。 - Morgan Stanley HTC預估第2季獲利太樂觀,從先前釋出的財測來看,執行率恐要打折。雖然旗艦款M8將帶動產品組合,但在高階飽和下,預料中階款競爭力更勝於M8,但能見度相當有限,在經濟規模改善前,預估HTC第2季至第3季將持續虧損,全年每股虧損恐達1.87元。 - UBS 今年HTC智慧手機出貨年減3.3%約僅1920萬支,在Lenovo購併Motorola後,對HTC中高階款將有更大的壓力,今年每股恐虧損1.5元。 - CIMB 雖然HTC轉進中階款,但去年中階產品貢獻獲利僅有25%,是疲弱的產品線,今年要看HTC中階款進一步的布局策略,給予賣出評等,下修目標價至94元。 - Goldman Sachs  2011年1月10日加入HTC的原中國區總裁任偉光,在2013年8月的組織重整中,辭任總裁一職,由HTC北亞區總裁董俊良兼任,而任則改任中國區新業務拓展。當時外界咸認,任偉光遲早離開HTC。如今坐實,任偉光已跳槽至Electrolux中國區擔任總經理。 自1997年起即歷任Nokia、Simens、Motorola、LG、HTC等手機廠高管,任偉光是手機行業的資深老兵,如今棄手機,轉投家電。 |

|

|

|

Silent Member

加入日期: Nov 2013

文章: 0

|

網購系統升級,7吋平板意外誤植半價,Lenovo慘賠上億人民幣。

2014年3月18日,由於聯想官方商城系統後台合併升級,引致錯將原售價為1888元的3G版本聯想平板電腦S5000標成了999元,並致京東商城以同樣價格出售這款產品。聯想鄭重承諾,我們不會取消3月18日在聯想官方商城和京東商城的訂單,並將依照下單價格按時發貨。對於受影響的顧客,我們再次致以衷心的歉意。 - Lenovo   據悉,從18日早上8點京東改價後,在不到2小時內,賣出了超過10萬台S5000平板,聯想將為此損失近億元。 有大廠風範,好樣的! 此文章於 2014-03-19 03:54 PM 被 weiter5494 編輯. |

|

|

|

Regular Member

加入日期: Jun 2012

文章: 59

|

引用:

你真的相信這個?看了一下S5000的規格,感覺只是個跟京東合作的銷售手法罷了∼ |

|

|

|