|

||

|

Silent Member

加入日期: Nov 2013

文章: 0

|

引用:

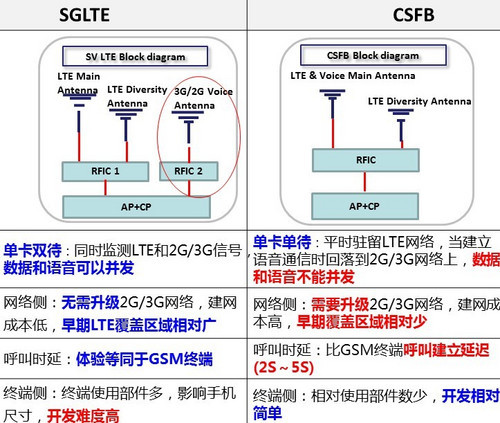

面臨4G網路語音服務品質不良的窘態,中移動積極改善CSFB瓶頸,設備供應商ZTE的eSRVCC switching跟Huawei的Ultra-Flash CS將陸續到位,成為短期方案。後者已與高通MSM8974完成相容性測試。  成本較高而鮮為人用的dual radio雙待機方案,不受CSFB品質影響,此刻成為市場當紅炸子雞。Samsung Galaxy Note 2/3乘勢於媒體大作文章,戮力宣傳。 |

||||||||

|

|

|

Silent Member

加入日期: Dec 2013

文章: 0

|

http://spiderman186.pixnet.net/blog/post/103045483

在2013年第四季財報發表會上,英特爾執行長Brian Krzanich宣布當季營收成長3%、利潤成長6%,主要歸功於 PC 業務需求穩定,同時平板裝置與資料中心業務溫和成長。不過針對Fab 42取消開幕,Krzanich坦承,英特爾在三年前過度樂觀預估PC晶片需求;他表示,新晶圓廠興建計畫都需要提早展開,而Fab 42的廠房已經完工,並未裝機。 由於PC市場衰退,英特爾 2013年整體營收也縮水了1%,不過該公司桌上型PC業務2013年還是成長了11%,同時雲端與儲存業務各自成長了35%與24%,高性能運算業務成長18%,但企業應用領域表現則不如預期;此外英特爾網路業務成長31%,NAND業務成長15%。 英特爾一位發言人則表示,Fab 42所在的該公司亞利桑那州據點,是最新14奈米製程量產的前哨站,而當地現有其他晶圓廠產能都可生產22奈米與14奈米製程。他強調,Fab 42廠是延遲開幕而非有些報導所說的「關閉」,14奈米製程仍能在現有其他廠房生產,新廠房將保留給未來的新技術,提供產能調度的彈性。 至於英特爾在第四季財報發表會後傳出裁員,該公司發言人Chris Kraeute證實該訊息,但表示無法透露更多細節,僅表示這是「配合業務需求調整資源的關鍵決策」,並強調:「我們會定期確認人力資源能因應業務需求,而目前我們正在重新安排特定計畫的優先順序,因此使得公司人力有所變動。」 |

||

|

|

|

Silent Member

加入日期: Dec 2013

文章: 0

|

http://spiderman186.pixnet.net/blog/post/103001623

Intel 把CPU + PMU + GPU給SOC化後,台廠的Power IC vendor 不知後勢如何啊? |

|

|

|

Silent Member

加入日期: Nov 2013

文章: 0

|

暫緩Fab 42的建置,轉而升級Arizona另兩座12吋廠為14nm製程,是明智之舉,對Intel目前約八成的稼動率有提升的助益。當初Intel擴廠計劃的確高估了PC市場的未來跟輕視了Mobile SoC的前景,在目前舊世代跟新世代PC處理器的總需求並不需要新的12吋廠,而Atom處理器在智機跟平板尚處於小眾,量更不需要新產能。

PCG整體營收在2013全年是衰退的,尤其是前三季,都是減收減益;只有第四季是平收增益(應是Haswell新品加持而來的高收益)。PCG主要包括桌機跟筆電兩大區塊,桌機營收增長意味著筆電衰退更大。 Cloud、Storage、HPC、Enterprise都是歸屬在DCG,而DCG的整體成長遠低於市場預期,是Intel遭受的最大質疑。Intel歸咎於企業IT支出增速未如設想,加以美國政府機關停擺。有趣的是,Intel提到cloud分食了企業市場,前者增收的部分約當於後者減少的部分。 NAND劃分在All Other,連著2012、2013年都是虧損,2013年營收年增近20%,最終仍虧損逾22億鎂,營損率比行動晶片部門還高,算是哥倆好。 總體而論,DCG獲利被兩個敗家子吃光了,PCG獲利幾乎等於Intel總營益,還年減近15%。雖然還是傲人的122億鎂成績,降幅可嚇壞一缸子人。 Silvermont的電源管理源自Haswell,後者整合電管模組後,桌機跟筆電所需的周邊power元件大幅減少,是台廠的暗傷。至於在mobile SoC上,ARM陣營一向都有獨立的一顆PMIC,且都是外包給國外第三方專業廠商(MTK的PMIC不知是否in-house?),這方面台廠也沒分到餅。Silvemont連PMIC都不需要,台廠一樣望春風。 此文章於 2014-01-24 10:38 PM 被 weiter5494 編輯. |

|

|

|

Silent Member

加入日期: Nov 2013

文章: 0

|

據Samsung上季財報顯示,Device Solution中的半導體事業群,整體營收較前季增加7.2%,年增8.9%。然營益卻季減3.4%、年增40.1%。 非記憶體產品(邏輯IC,含foundry)營收季增16.3%、年減8%。 Samsung Improved earnings through migration and increased high value-added product mix. • DRAM:Enhanced cost competitiveness by expanding 20nm-class;Managed flexible product-mix according to market conditions based on high value-added product competitiveness. • NAND:Increased 10nm-class portion and expanded solution product sales including SSD. • System LSI:Overall sales slightly up due to lower-than-expected demand for high-end mobile components, while AP shipments increased for major customer's new products. 看來Apple寒冬送暖,讓Samsung SoC部門稍有喘息。 In 2014,Samsung expects server/graphic DRAM demand to remain solid amid limited supply growth; tablet and mid-to low-end smartphone to drive demand for mobile devices,and NAMD demand to remain solid led by increased SSD adoption by datacenter and content growth in mobile devices. As for system LSI,Samsung expects to introduce 20nm-class mobile AP and to expand new customer base, expecting to enhance competitiveness of LSI products such as high-pixel CIS, seeing low demand of S.LSI for 1Q14 due to weak seasonality and inventory adjustment by customers. 20nm的mobile AP應該是衝TSMC來的。 |

|

|

|

Silent Member

加入日期: Nov 2013

文章: 0

|

TSMC兩大FPGA客戶報佳績。

Xilinx上季$586.8 million營收遜于預期,然 $0.61 EPS優於預期;本季展望2%~6%溫和成長,令市場略有失望。 Xilinx cited $100 million in sales of the company’s chips using 28-nanometer technology, driven by design wins in wireless communications, industrial, aerospace, and defense products. The company also touted its having shipped the first programmable chips in the industry using 20-nanometer technology in November. Altera上季$454.4 million營收與$0.31 EPS均優於預期;然本季展望2%~6%下滑,令市場略有失望。 Altera cited growth from “a diverse blend of end markets.” 先出了再說?ASML已於去年底出貨三台各首付6000萬歐元的EUV光刻機,尾款1000萬歐元於該設備升級至量產水平時付清。今年上半與下半年各再出2台跟6台。 ASML actually shipped three systems in the closing quarter of 2013. The first of those is said to be already exposing wafers being designed in readiness for the forthcoming 10 nm production “node”. ASML目前出貨的EUV已能每小時處理50片晶圓。 ASML had demonstrated in its own factory the capability to produce as many as 50 wafers per hour on EUV systems and that the company remains on target to deliver systems with a throughput of 70 wafers per hour this year, upgradeable to 125 wafers in 2015. The current EUV systems are at a level that is good enough for initial production for our customers who don’t emphasize speed. But our customers also need stability, so they can meet economic targets. It is expected to reach required stability levels in the second half of 2016 or in 2017. Some customers with a higher appetite for risk are currently ordering EUV systems, and these customers may upgrade for higher productivity once the new machines are ready. - Peter Wennink, CEO of ASML The progress on EUV is good. The question is, however, how long the machines can keep up operating without any interruptions. If the machines operate for two hours and are then out of use for six hours, it would still be an expensive machine. - Robin van den Broek at ING Bank 三巨頭暫停CapEx競賽,今年半導體業看來是審慎而無驚喜。 Given the slow down, Samsung has decided to get cautious and is keeping its capex flat for 2014 over 2013 for its initial planning. It should be noted that this is the first time since the financial crisis that in 2009 that they haven’t increased their capex. It would seem that even though they have retained a lot of Apple chip business that TSMC couldn’t handle, even that wasn’t enough of a reason to keep spending [...] We have now heard that Intel will be flat to down in capex (though most all of it will be on equipment as they clearly aren’t building any more buildings). TSMC also announced flat capex and now Samsung is getting conservative and going to flat capex as well. Maybe my calculator is broken but I still have a hard time getting to the 15% capex increase many are calling for or even the 10% capex KLAC mentioned on their call tonight. Am I missing something? - Robert Maire of Semiconductor Advisors It would appear based on the ongoing shift of Apple application processor production to TSMC, plus a slight smartphone cooldown, that System LSI fab utilization for application processor production was weaker. Samsung pulled-in shipments in 4Q13 from equipment vendor KLA-Tencor for its 3D NAND fab in Xian China (high volume production level). Samsung’s competitors such as Micron, SK Hynix and Toshiba/Sandisk orders are mainly spending at R&D levels. Foundry orders mainly help up by TSM 20nm/16nm orders. Global Foundries and UMC pushed out some orders. Recall that ASML suggested a digestion delay in 20nm spending. - Srini Sundararajan of Summit Research Partners 除了先前曝光的六核Exynos 5260,再傳Samsung GS5具體規格中,出現了兩顆Exynos SoC,一是20nm的八核Exynos 5430,另一是28nm的Exynos 5422。另外還有Samsung新版基頻CMC300!  |

|

|

|

Silent Member

加入日期: Nov 2013

文章: 0

|

UBS研調指出,中國政府於去年第4季起積極發展當地半導體行業,未來10年內將提供1000億元人民幣的補貼,預期嘉惠當地IC設計公司,SMIC與其向有穩固的合作關係,相信亦能雞犬升天。

SMIC受惠於稼動率及經營效率提高,過去3年成功扭虧為盈,相信即使缺乏政府補貼,亦能維持獲利。 整合內部設計服務團隊以及多家第三方IP合作夥伴的100多項IP,SMIC宣佈正式進入28nm製程,對外提供包含28nm PolySiON和28nm HKMG在內的MPW(multi project wafer)服務。 The first SMIC 28nm MPW shuttle included both 28PS and 28HKMG related customer products for verification, and was launched at the end of 2013 as planned. By taking more MPW shuttles in 2014, we will continue to take more positive steps to strengthen and diversify our technology offerings and meet customers' growing demands on both advanced and differentiated technologies. - 李序武, executive VP of technology development at SMIC 另一方面,台灣的UMC表示,28nm營收僅占其2013營收約低個位數比例。 UMC saw 40nm and more advanced processes account for a combined 24% of its total revenues in the fourth quarter compared to 15% during the same period of 2012. UMC also disclosed its 28nm technology will account for a low single digit percentage of company revenues by the end of 2013. UMC now has more than 20 customers for its 28nm processes, and has attained tape-out for 30 IC products UMC is looking to skip 20nm and move directly to 14nm FinFET process technology. The foundry has been in part of the IBM joint technology development alliance, whose members include Globalfoundries and Samsung Electronics. |

|

|

|

*停權中*

加入日期: Jan 2014 您的住址: 幽冥深淵

文章: 232

|

引用:

要是台灣島跟中共國同時起步發展 台灣島大概不用玩了 大家要感謝蔣經國、孫運璿、李國鼎以及毛澤東 |

|

|

|

|

Silent Member

加入日期: Nov 2013

文章: 0

|

強攻平板,Intel Bay Trail-T再添新血。

除了現行的四核Z3740(1.33~1.86 GHz)/Z3770(1.46~2.39 GHz),更高階的Z3775D(1.49~2.4 GHz)跟更低階的Z3730D即將加入戰局。  Antutu跑分顯示,1.5GHz的Z3775D在Android下37,265分的效能不亞於Qualcomm S800!  Z3735G scores based on an Intel prototype SW5-011A - 1024×768 - 2GB RAM/32GB ROM - Android 4.4.2 Z3735G scores based on Acer SW5-011A - 1280×800 - 1GB RAM/16GB ROM - Android 4.3 |

|

|

|

*停權中*

加入日期: Nov 2005 您的住址: Greed Island

文章: 402

|

引用:

引用:

|

||

|

|