|

||

|

*停權中*

加入日期: Oct 2003

文章: 472

|

蘋果會讓三星代工應該有一些其他因素在

不然早轉給台積或其他IBM體系的代工廠了 不過如果是生產不出來,就肯定會轉了 |

|||||||

|

|

|

Silent Member

加入日期: Nov 2013

文章: 0

|

德意志證券指出,台積電20nm製程良率已提昇到50到70%的水準,反觀三星新佈建的20nm卻面臨遲遲無法按預期供給,因此蘋果打算將A8的訂單全數交給台積電,而A7則全部交由三星以28nm的製程生產。

- Technews.tw@Feb 26'2014 市場預期,因台積電20奈米良率不斷提高,為蘋果生產的A8處理器將足以供應蘋果於今夏可能上市的iPhone 6,而台積電20奈米製程將在第二季放量,三星20奈米仍未進入量產階段。 - Appledaily@Mar 4'2014 三星已和蘋果簽署協議,將與台積電共同為蘋果生產A8處理器晶片,預定第二季在為蘋果iPhone 5s和iPad Air生產64位元A7處理器的德州廠開始量產,今秋開始出貨,目前正在進行最終階段的測試。 - ZDNet Korea@Mar 11'2014  日前華爾街則傳出TSMC削減在20nm製程的資本支出。 Our most recent conversation with the Taiwan eco-system suggests TSM has recently lowered its targeted 20nm capacity plans by 10%. TSM is now planning to have 40k-45k wpm of 20nm capacity by YE14 (with the majority installed in 1H14), lower than prior expectations of 45k-50k wpm. Although we do not expect this to lead to a down tick in TSM’s CY14 capex budget (of ~$10B), it does increase the downside risk to the current investors expectations (of upward revision). - Mehdi Hosseini of Susquehanna Financial Group@Mar 17'2014 也有人指出TSMC與Samsung目前在20nm製程皆遇瓶頸。雖然Samsung的Q1量產目標維持不變,但仍無解決方案;TSMC則已停機三周,然預估在兩周必可解決問題,屆時可繼續放量生產。 In our last Apple Update on March 6th, we noted that both Samsung and TSM were struggling with the Apple 20nm technology node. Our latest checks indicate that Samsung production plans remain on indefinite hold for this technology due to significant yield issues, while TSM had to make some tweaks in their CMP process aluminum slurry and Fujimi’s barrier slurry layers, which put their 20nm production on hold for the last three weeks. TSM is estimating another two weeks to resolve the issue and to resume the full production ramp plans. The latest production reads and forecast for the 20nm technology node at TSM indicates that they will be ramping from their current levels of 8,000 to 10,000 wpm to an estimated 30,000 wpm by the month of June. These ramp plans at TSMC would be consistent with a new Apple product introduction in the September timeframe. One key question to ponder is if Samsung can’t resolve their yield issues soon, will it be too late for them to participate in this technology node or do they need to re-focus their resources on the 14nm technology node instead. - John Donovan and Steve Mullane of BlueFin Research Partners@Mar 18'2014 法巴則認為技術問題已獲解決,良率來到五成。 台積20奈米已在1月下旬、於南科的Fab 14正式投片量產,而即使在上個月台積於20奈米量產上遭遇了些許問題,不過經由選擇另一種不同的研磨液(slurry),台積已順利解決了在CMP(化學機械平坦化)製程的挑戰,台積的20奈米製程良率,也一舉提升至50%。 - BNP Paribas@Mar 18'2014 訊息分歧,仍須多方觀察。 |

||

|

|

|

Silent Member

加入日期: Nov 2013

文章: 0

|

中國全面啟動LTE營運,三大電信業者全面開打。

中移動2014年目標銷售TD終端2.2億台,其中4G手機1億支。 中聯通年內預計2014年銷售1億支訂製手機,其中4G手機超過5000萬支。 中電信目標年內銷售終端1億台,其中4G手機3600萬支。 三大電信渠道合計4G手機共1.86億支,占比約45%。 改弦易轍,以大欺小?高通4G力壓聯發科3G! 以今年來看,中國的4G智慧型手機將很快可以看到千元人民幣的時代來臨,甚至在年底前達到599人民幣的水準。 - Alex Katouzian, SVP of Qualcomm Marvel PXA1088 LTE方案的Coolpad 8705來到¥799,高通MSM8926方案的ZTE Q801U來到¥999,而集中在第二季開始銷售的中低價(<¥2000)4G手機幾為S400的MSM8926方案囊括。年中64位元S410上陣,第四季S610、S615出擊,轉移戰場的意味濃厚。    聯發科MT6290數據晶片(即原稱MT6590)原本預計在今年第二季至第三季通過3模TD-LTE的SG-LTE與CSFB認證,第四季再通過5模認證,若無法提早通過5模認證,考量到目前中國移動60%至70%的TD-LTE手機透過補貼銷售,資源有限的手機廠商為爭取補貼,勢必會優先導入高通與Marvell、暫緩聯發科的LTE SoC解決方案。 - KGI 即便聯發科4G晶片可以追上競爭對手腳步,但考量到生產成本增加(預估將較3G晶片高約180%)恐不利於定價、甚至會低於3G晶片(尤其是中階產品),聯發科一旦開始銷售4G晶片,對明年毛利率幫助不會太大。 - CIMB Securities 雖然聯發科是最有能耐與高通在5模競爭的廠商,但目前看來,能通過「531 3模補貼」大限的手機廠商,大多不是聯發科的客戶,等於衝擊未來2季營收動能。 - JP Morgan 聯發科在大陸4G市場進度落後,聯發科營運難以維持高成長動能。 - Citi Global 中國移動補貼政策的調整,對高通與聯發科等龍頭廠商最為有利,尤其是聯發科,中長期可望受惠,因為中國移動新補貼政策可提供聯發科更多與客戶進行產品合作的前置時間(lead time)。 - Deutsche Bank 中移動轉進補貼4G 5模手機,可能會抑制2014年LTE 手機的需求,反而激勵3G市場需求,除非中移動加重補貼才能達到先前LTE出貨量的目標。因此看好聯發科仍可受惠3G市場和獲利持續提升。聯發科今年也僅預估約1500萬套LTE晶片產品(佔今年出貨比5%)的出貨量,真正量能起飛要待今年下半年。 - Nomura Securites 聯發科釋出五模LTE晶片下半年在中國市場銷售將十分強勁的訊息,尤其在當地電信商的補貼下,大陸LTE手機規模將達到1億至1.4億支。 - Merrill Lynch 兩者皆是TSMC的主力客戶,會是零和遊戲嗎? |

|

|

|

Silent Member

加入日期: Feb 2014

文章: 0

|

請問W大,

大陸面板產能,無限制產出,那麼高階如JDI、LG、sharp,還有多久的優大優勢? 尤其如IGZO後續發展?4K2K各廠的水準? 再者,半導體代工大廠支出,高度製程軍備競爭之下, 有時我想,買台積電股票,可能還不如買在東協布局的台塑or其他, 還比較有未來性....可能的話,連生產雞肉的大成食品, 也都可能比未來台雞店要穩定  大成這10年,從小雞成長到能生蛋的母雞,每年都縮短製程幾天, 快到雞的物理極限了...生物成長製程也提升不少  (不知道吃了多少抗生素喔^_^") 半導體目前,除非掌握有外星科技,物理之壁可能會擊潰不少廠商... 過去,w大在 靈異 有很多超水準面板業文章, 回文感覺上,東協塑化、煉鋼,應該也有所涉獵, 而且投資單位還不小... 只侷限半導體討論,有些可惜。 (量子電腦那邊,太虛幻就是了) |

|

|

|

Silent Member

加入日期: Nov 2013

文章: 0

|

本來在另一樓有分享一些顯示產業訊息,前陣子有些疏懶而忽略了,真是抱歉。

目前日韓中小面板業在高階產品LTPS依然有優勢,JDI、Sharp最近都有接到小米、中興的訂單,在中國手機OEM眼中,FHD等級的應該不會考慮陸廠,但在中低階手機走揚的新興市場趨勢下,陸廠可能獲得更多練兵與賺錢的機會,尤其是近期大舉投資在LTPS、IGZO、AMOLED上,估計在三年內可能大幅縮小與日韓差距。當然日韓不會在這三年內毫無進展,只是中國具有市場跟資源兩大優勢,不外銷也足以支撐產業,還有政策助陣,基本立於不敗之地。 大尺寸面板上,陸場優勢更大。以其瘋狂擴廠的速度跟拿4K當高清賣的壯舉,日韓也難擋。估計在OLED TV還無法接棒的當下市場,共軍的茁壯速度將飛快,單靠技術發展恐難挫其銳氣。 我極少談股價,不過個人看法是,若非長期投資者,追求的多是成長性,而非其絕對價值,這恰巧也是近期Apple股性的關鍵。若營收、獲利依舊有題材,股價自然有空間。IT產業的想像空間的確要比傳產活潑,當然人多的地方也要特別小心,常有看不見的黑手。 |

|

|

|

Silent Member

加入日期: Feb 2014

文章: 0

|

老驥伏櫪,志在千里。

有時看討論時,會多所思考問題、未來產業方向。 比方說台灣JDI經理,在工商時報的訪問, 感覺JDI獲利、技術上,都還不錯.... 但友達卻混的不是很好!?甚至看空未來, 01上,兩個左岸同胞,倒是對自家的面板業,相當看好。 (不知道那來的自信....   ) )鋼鐵、塑化業,還有區域供需條件和運送問題, 管理得宜的話,還是能獲利(比方說台塑集團) 面板業產能開出來後,內外需市場,能否能吃下?! 小弟相當懷疑.... 請問...是那個樓有討論面板?請W大給個連捷網址... |

|

|

|

Silent Member

加入日期: Nov 2013

文章: 0

|

|

|

|

|

Silent Member

加入日期: Nov 2013

文章: 0

|

機海論智,螢屏競大,價安為王,核芯必八!

原本定位¥1500~2000中階手機的真八核MT6592,在廠商的狂操下,瞬入殺戮紅海。 ¥799 - 紅米Note/TD+G/[email protected]/5.5”@720p/1GB RAM/8GB ROM/R13MP/F5MP/3200mAh ¥999 - 紅米Note/TD+G/[email protected]/5.5”@720p/2GB RAM/8GB ROM/R13MP/F5MP/3200mAh ¥888 - 酷派大神F1/W+G/MT6592@GHz/5.0”@720p/2GB RAM/8GB ROM/R13MP/F5MP/2500mAh ¥798 - 榮耀3C/TD+G/[email protected]/5.0”@720p/1GB RAM/GB ROM/[email protected]/[email protected]/2300mAh ¥998 - 榮耀3X暢玩版/TD+G/[email protected]/5.5”@720p/2GB RAM/8GB ROM/R13MP@/F5MP/3000mAh ¥788 - 聯想黃金鬥士S8/TD+G/[email protected]/5.3”@720p/1GB RAM/8GB ROM/R13MP/F5MP/3000mAh ¥988 - 聯想黃金鬥士S8/TD+G/[email protected]/5.3”@720p/2GB RAM/16GB ROM/R13MP/F5MP/3000mAh ¥998 - nibiru H1/TD+G/[email protected]/5.0”@1080p/2GB RAM/16GB ROM/ R13MP/F5MP/2000mAh ¥799已是大屏真八核的標竿價位,紅米再度引爆高配低價鏖戰。逐鹿中原者,豈甘寂寞?   MTK效應說明了何以空頭引三大隱憂唱衰高通。 Three-fold threat to Qualcomm in the China marke: 1.Taiwan’s MediaTek and other lower-cost providers could derail Qualcomm’s sales. 對手低價晶片將阻礙高通在華銷售。 2.China could bring down Qualcomm’s average selling price. 中國低價手機大行其道,將拉低高通產品售價。 3.China’s regulators could impose harsh requirements on Qualcomm. 中國監管單位可能對高通施加嚴苛要求。 然多頭Bernstein明顯非常不以為然。 Most competitors for the China market are well behind Qualcomm on integration, geometry, and radio technology, and Qualcomm holds the majority of sockets currently certified for use on China Mobile’s forthcoming LTE network. Of the primary competitive candidates, MediaTek is likely the most viable (and fierce) competitor, and understands well how to do business in China. However, Qualcomm’s challenges on 3G have been, in our opinion, more on marketing to the Chinese consumer than anything else. And, it appears Qualcomm is now getting much more responsive to the demands of Chinese market. Despite previously deriding octa-core chips as a marketing gimmick, Qualcomm is fully embracing the multi-core trends, announcing its own octa-core chip, the Snapdragon 615 (or MSM8939) at the MWC. The chip clearly is aimed to counter MediaTek’s success in the octa-core segment, and is targeted at the mid range. Similarly, in another marketing effort Qualcomm is targeting their first 64 bit chip (the Snapdragon 410 MSM8916) designed specifically for the needs of the lower-end China market, delivering high performance into lower end segments at attractive price points. Fears of ASP decline have been part and parcel with Qualcomm ever since the “Great ASP Debacle” of 2010. However, mix to emerging markets is not new; QCOM’s QTL unit growth has been driven by this shift for years. ASPs have increased markedly since that time, even as emerging market growth has substantially outpaced unit growth in developed markets, more than offsetting negative mix as the smartphone cycle continued apace. As the 4G market, over the next few years, potentially transitions here we would love to see QCOM put a framework in place to capture payments; even if at a lower rate we believe they would still be substantially accretive as this large “shadow volume” of 3G moves over into royalty-bearing mode. We estimate substantial accretive contribution from China Mobile LTE to Qualcomm’s royalties as a result, even if it comes at a lower rate. The push toward 5-mode chipsets may help with this [...] Additionally, it appears that Qualcomm is upping their engagement with China. We note recent news that Qualcomm is engaging with SMIC for 28nm products. While Qualcomm has indicated they will be upping their foundry multi-sourcing efforts, we were somewhat surprised to see SMIC mentioned at least in the guise of 28nm, and SMICs inferior capabilities vs. TSMC or Samsung all suggest limited benefits to QCOM from a strict multi-sourcing perspective (benefits on pricing, flex capacity, etc). Benefits to Qualcomm from assuaging China, however, could in theory be much more substantial, and the timing of the newsflow (in the middle of the investigation) suggests other motives may indeed be at play. - Stacy Rasgon of Bernstein Research 敦親睦鄰,Qualcomm向SMIC拋媚眼? |

|

|

|

Silent Member

加入日期: Nov 2013

文章: 0

|

MTK「真八核」平台剛推出時的定位是在中端千元以上手機市場跟高通抗衡。酷派大神F1首祭出888元超低價,打亂了MTK的市場佈局,MTK曾一度決定斷貨酷派三個月。然中國4G商用後,電信三大腕的「推進4G千元機的普及,主推五模十頻」終端策略獨尊4G,勢讓高通一家獨大,迫使MTK順水推舟,玩得更大。

- 手機中國聯盟 MTK推八核入火坑的壯舉,雖在穩住陣腳,不但盡顯在LTE產品上的窘態,同時讓利八核來成就一眾殺紅眼的手機OEM,也必然在其晶片獲利跟其上游供應鏈上形成不小壓力,28nm的投片將更加審慎。 而同樣事關4G,ZTE的4G基頻WisFone 7510已通過中移動認證,成為中國第一家合格的國產LTE晶片,雖與高通、美滿、博通的整合SoC尚有距離,但進度上已超前MTK半年。估計海思下個季度可追隨ZTE腳步。  此文章於 2014-03-23 10:55 PM 被 weiter5494 編輯. |

|

|

|

Silent Member

加入日期: Nov 2013

文章: 0

|

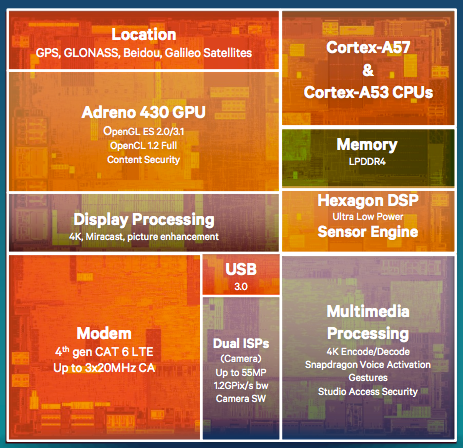

錯愕?驚喜?

以自家Krait異步多核架構自豪,還揶揄過ARM大小核big.LITTLE的Qualcomm,推出的旗艦級64位元SoC竟然是ARM的A57標準核帶big.LITTLE,令人愕然! The designs are divided into two discrete CPU clusters (one for the A53s and one for the A57s). Within a cluster all of the cores have to operate at the same frequency (a change from previous Snapdragon designs), but each cluster can operate at a different frequency (which makes sense given the different frequency targets for these two core types). 64-bit時代,Android陣營眾人緘默,唯ARM獨領風騷與Apple抗衡,一統江山,暗自竊喜? Although these are vanilla ARM designs, Qualcomm will be using its own optimized cells and libraries, which may translate into better power/performance compared to a truly off-the-shelf design. We'll finally hear about Qualcomm's own custom 64-bit architecture later this year, but it's clear that all 64-bit Snapdragon SoCs shipping in 2014 (and early 2015) will use ARM CPU IP. This likely means we won't see Qualcomm's own 64-bit CPU microarchitecture show up in products until the second half of next year. - Anandtech Qualcomm went to great lengths to say that the use of the vanilla ARM cores in both parts are not a sign of anything right or wrong with their internal 64-bit V8 compatible core. That core is coming but when and in what guise was not said. The 810 and 808 are here now, the yet unnamed Qualcomm 64-bit core is not so move along nothing to see here. Our moles have confirmed this lack of greater meaning, these two are basically a stopgap part while the 64-bit internal core is undergoing the old final buff and polish. - SemiAccurate     Qualcomm六四艦隊全員到齊,從四核A53、八核A53、六核A57+A53,到八核A57+A53,一應俱全。S810/S808算是全面加持,大小核架構、MDM9x35基頻、Adreno 418/430 GPU、H.265 encoding、20nm node,都給了。不過實在族繁不及備載,WiFi與BT、FM只能踢掉了。 PS:In terms of graphics performance, the Adreno 418 is apparently 20% faster than the Adreno 330, and the Adreno 430 is over 80% faster than the Adreno 330 we have in Snapdragon 800/801 today.     最頂級的拍照規格。  3Band-enabled載波聚合,300/100 Mbps的超高速手機上網,雖然目前還用不到。 PS:Enabling 3x LTE CA requires two RF transceiver front ends: Qualcomm's WTR3925 and WTR3905. The WTR3925 is a single chip, 2x CA RF transceiver and you need the WTR3905 to add support for combining another carrier. |

|

|