|

||

|

Silent Member

加入日期: Nov 2013

文章: 0

|

引用:

引用:

假設Tegra K1與Apple A7為相同die size下,CPU/GPU的面積對比。  除了nVidia原廠參考設計公板,Lenovo的ThinkVision 28應是CES展中唯一搭配Tegra K1的廠商實機。  此機定調28吋專業級4K顯示器,七月發售,售價1000鎂,還能跑Android,算是Android AIO吧! 32GB eMMC storage, a microSD slot, three USB 3.0 ports, one USB 2.0 port, one microUSB 3.0 port, audio in/out, speakers, mics, webcam, Ethernet, Wi-Fi, Bluetooth 4.0, NFC, Miracast, three HDMI ports, one DisplayPort, and a 10-point touchscreen. 從nVidia公板跟Thinkvision 28測出的基準效能顯示,K1的GPU效能不但秒爆一眾SoC同儕,還超越了桌機等級的Intel內顯。      驚世駭俗之餘,Tegra K1的功耗除了idle時『靜如處子』,可不要active時『動如脫兔』,甚至『猛虎出閘』才是。 |

|||||||||

|

|

|

Regular Member

加入日期: Apr 2008

文章: 80

|

這個討論我一點都看不懂~太深奧了!

__________________

http://class.ruten.com.tw/user/index00.php?s=victor http://tw.user.bid.yahoo.com/tw/booth/Y8433205965 我的拍賣 燦坤卡號:30042267 歡迎使用 |

||

|

|

|

Basic Member

加入日期: Aug 2004

文章: 16

|

刪除.............................................................................

此文章於 2014-01-14 04:51 PM 被 darkxz 編輯. |

|

|

|

Silent Member

加入日期: Nov 2013

文章: 0

|

引用:

Marvell近來諸事順利,LTE產品喜訊頻傳,還有私募基金KKR入股6.8%,量能皆備之餘,Intel向其頻頻招手。後者雖然不是TSMC前三大客戶之一,面子問題TSMC也要兢兢業業。 We believe that Intel is gaining customer traction in their foundry business, consistent with the company’s recent commentary to open their foundry services to additional customers. We believe Marvell is a potential good fit for Intel in integrated baseband/application processors. Our sense is that performance gains using Intel’s 22nm FinFet process would be substantial for Marvell, providing the catalyst for this relationship. Marvell would be a particularly suitable candidate given their strong relationship with Intel (they acquired Intel’s communications and applications processor business in 2006). Meanwhile, Marvell is enjoying some near-term momentum, having just qualified for VoLTE on AT&T and recently announcing wins at ZTE and Coolpad for TD-LTE baseband/AP, boding well for future volumes. - Glen Yeung of Citigroup 引用:

20nm製程成本沒有更便宜,已是業界共識。EDA大廠明導曾指出,20nm製程將是首個無法降低晶片成本的製程。 At 20nm,the first node ever which will not deliver cheaper chips, there will be no cost/transistor cross-over for the first time in history. It’s very disturbing. Traditionally the cost per wafer increases 15/20% at each node. With FinFET, the cost increase is more like 40%. Added to that is the additional cost of double-patterning which comes in at 20nm. - Wally Rhines, CEO of Mentor Graphics@IEF2013 in Dublin 而TSMC技術高層也明瞭28nm之後的成本上揚幅度驚人。 The prospective cost of a 10nm wafer appeared to be about 4x the cost of a 28nm wafer. We need many innovations to bring the cost down. The two most important innovations to achieve this are 450mm and EUV. Progress towards 250W source power EUV,which I expect to see it by 2015, must not slow down, - 施奕強, senior director for R&D at TSMC@IEF2013 in Dublin 這是近年來業界紛紛疑慮Moore's law已至盡頭,微縮技術將窮,須加上先進封裝技術來持續提高整合度,維持成本優勢。某種程度上,這解釋了TSMC為何在數年前便決定跨界封裝領域,發展CoWoS! 引用:

Bulk Si材料特性不如SOI, 卻是成本低廉;當年大力挹注SOI技術者,如GloFo,反成了冤大頭。在戮力搶單TSMC的28nm客戶之餘,GloFo依然持續替STMicro代工28nm FD-SOI產品。稍早前STMicro成功展示了標準電壓下速度高達3GHz(極低電壓下亦可達1GHz)的Cortex-A9產品。 若以平面電晶體應用在Intel的22nm製程搭配FD-SOI,無須3D FinFET即可達成具競爭力的功耗效能,特別是還能沿用原先閘極先製的製程。據傳Intel擬簽約取得FD-SOI技術授權,來搭配14nm以下製程。   mobility更好的三五族元素也是個選項,IMEC發展藍圖已規劃至5nm,7nm時加入三五族元素,並已成功在10nm製程中以SiGe取代Si。 華爾街點名Intel在明年使用三五族元素製程在自家產品,不排除也透過此新製程進軍晶圓代工業。 Intel is expected to initiate chip production using III-V semiconductor circuits, potentially as early as 2015. The use of III-V compounds as channel materials (possibly on SOI substrates) create the potential for substantial power savings in addition to the benefit of extending a roadmap of future shrinks. While III-V makes the most sense for logic devices (e.g. Intel’s own microprocessors), we anticipate Intel will offer this process to prospective foundry customers as well […] Producing baseband/AP chips for Marvell indeed implies that Intel will be fabricating ARM solutions on their 22nm process. |

|||

|

|

|

Silent Member

加入日期: Dec 2013

文章: 0

|

引用:

看來第三家已經出現了 就是hisilicon.. 不過看來Hisilicon仍以高階為主.. 就看看余大嘴的信用好不好了 --------------------------------------------- 报告大家一个好消息:海思28nm HPM工艺A9四核,以及高端八核(四核A15+四核A7)都已经推出,并且都是SOC方案,芯片集成了GSM/WCDMA/TDS/TD-LTE/FDD-LTE通信Modem。最近双卡双待Ascend P6S手机已经开始发货,Mate2也将在春节后上市,后面还有一批高端新品会采用海思、高通及MTK芯片,竞争力会越来越强! 此文章於 2014-01-15 08:40 AM 被 johanneschuang 編輯. |

|

|

|

|

Silent Member

加入日期: Nov 2013

文章: 0

|

余大嘴的封號豈是『浪得虛名』? 64位元8核處理器自其口迸出,更顯相得益彰。  「華為八核4G芯片已形成出貨能力,未來也將提供榮耀手機使用」。 以28HPm打造八核A15+A7帶LTE基頻,『熱情』超越Snapdragon 800,拭目以待。後續再以20SoC打造八核A57+A53帶LTE基頻,也是精采可期。 |

|

|

|

Silent Member

加入日期: Nov 2013

文章: 0

|

摩根大通認為,身為IDM的Intel,既有卓越的製程技術,也有自家產銷的X86處理器,當審慎區隔戰線,善用資源。

PC需求衰退雖是事實,但已逐漸築底,畢竟smart device無法完全取代生產力運算用途的PC;而前端smart device的蓬勃同時,也帶動後端server需求,ARM-based微伺服器短期內仍無法撼動X86架構地位。PC與server的消長互補,Intel已立於不敗之地。 Intel indicated it is lowering its spending on handsets by more than 20% YoY in 2014 versus 2012, as the company is focusing only on the largest handset makers. We believe the lower handset spending is another positive for the company as we have been saying that the smartphone applications processor market opportunity is too small to matter, and Intel architecture is not competitive in cost or power versus ARM. 寸長寸利,寸短寸險,一體兩面。在PC與server具優勢的X86,在smarrt device上明顯沒有優勢,Intel應降低對其投入以持盈保泰。 We believe way for Intel to gain material revenue and earnings from the “mobile” market (tablets/cell phones) is via foundry since x86 processors are not competitive versus ARM processors in non-Windows applications, i.e. almost every tablet and phone. We believe Intel is generating interest in its foundry business due to a combination of TSMC missteps and Intel promising a one year lead over TSMC and others at 10nm, which would reach production in 2016. Since Altera was announced in February 2013, Intel added Microsemi, and we believe Cisco and Brocade will follow. 反之,X86奠基的關鍵法寶 - 先進製程,極可能是Intel重返高獲利的要素。在對手落後至少一年差距的現狀下,Intel未來14/10nm的成本優勢,令其foundry事業前景看好。甚至Apple可能是潛在的入幕之賓。 Apple foundry business contributed roughly $3.9 billion in revenue for Samsung in 2012, and we estimate it could grow roughly 21% YoY to $4.7 billion in 2013. Our analysis indicates if Intel were to win 50% of Apple’s foundry business at 25% operating margins (roughly in line with Intel’s corporate average), it would add roughly $3.4 billion in incremental sales (6%) and $0.13 in EPS upside (6%) in 2017E. - J.J. Park with J.P. Morgan 秉持與小摩對Intel製程功力相同的信心,Jefferies & Co.進一步認為14/10nm將是Intel處理器在行動市場的轉捩點。 At the same time that Intel has started focusing on computing devices in mobile form factors, it appears that TSMC is hitting a wall on the transistor cost curve. We believe that due to Intel’s larger R&D budget, its recent focus on the mobile/tablet market, and its higher R&D spend relative to TSMC, that it will produce a lower cost transistor than TSMC for the first time ever in 4Q14. We believe Intel extends that cost lead 24 months after than in 2016. By 2016, Intel potentially has a 66% price advantage over TSMC-built ARM SoCs. Due to its superior Tri-gate transistor, Intel’s chips should also offer lower power, smaller footprint, and higher performance. We believe Intel stands to gain share in the tablet and handset markets as it brings to market 50% and 66% pricing advantages in 2015 and 2017. Gartner forecasts ~400m tablets ~1.5bn smartphones in 2016, and we expect Intel can achieve 50% share in the tablet market, and 20% share in the smartphone market. - Mark Lipacis of Jefferies & Co.   |

|

|

|

Silent Member

加入日期: Nov 2013

文章: 0

|

本周四即將公布季報的Intel,股價創18個月新高;華爾街多空交戰,論見分歧。

We think new management is changing the nature of the company, and putting more focus on mobile. Intel is probably investing more money in mobile than the rest of the chip industry, combined, and we think eventually it can work out for the company the way the PC did. - Bill Nygren of the Oak Mark Fund@CNBC’s “Smart Money: Half Time Report” PC市場疲軟,依然不容樂觀。 We are modeling Intel PC Client Group (PCG, 65% of sales) revenue down 1% and MPU units up 1% qoq for Q4, and 9% decline in PCG in Q1 versus 7% and 6% decline in 2013 and 2012, respectively. - Romit Shah of Nomura Equity Research 空方認為Intel賺慣了大錢,其以高附加價值的心態跨進foundry領域,注定難以衝量。同時,有量的行動處理器代工市場,Intel也會面臨自家SoC與客戶競爭的困境(品牌與代工?) We would classify Intel’s current foundry efforts as “high value, low volume.” The business today is characterized by a lack of strategic overlap with Intel’s current business, and reflective of markets with very high prices (for instance, high-end FPGAs can and do sell for thousands of dollars apiece) suggesting plenty of profit pool to spread around, and allowing Intel to value-price these services. A move to “high volume” foundry has many other issues. Some are strategic in nature – most of the high volume leading edge space is, of course, mobile SoCs, and area where Intel is trying to build out their own business (and foundries competing with their customers typically don’t do all that well). - Stacy Rasgon with Bernstein Research Rasgon也不看好Intel自家SoC在行動市場的獲利前景,畢竟SoC單價相對低,唯有取得相當市占來大量銷售才能滿足Intel現有的獲利水平;如此,Intel的產品可不是有競爭力就行了,而是要『超有競爭力』,光靠製程優勢只怕還不夠。 Intel is undergoing the beginnings of a structural business model transition that carries significant risk. The bigger issue faced by Intel is PRICE. These new markets support an ASP that is about a fifth of what Intel earns on a mainstream notebook MPU today. This implies that Intel needs to sell ~5 chips into new smartphone and tablets markets to equal one PC (and of course, if PCs really are entering secular decline, they would have to sell even more). This implies a need to take an enormous amount of market share simply to move the needle. In order to do this, Intel will need products that aren’t just competitive, or a little bit better, than the competition. Intel will need to be massively better than anything else in the marketplace in order to even hope to gain this kind of traction. Attempting to do this will require continued high levels of investment in both capex and R&D, during a period in which their business model is shifting away from their core, pressuring shareholder returns. And the end game is not guaranteed – process advantages may not necessarily translate to these types of share gains. |

|

|

|

Silent Member

加入日期: Nov 2013

文章: 0

|

引用:

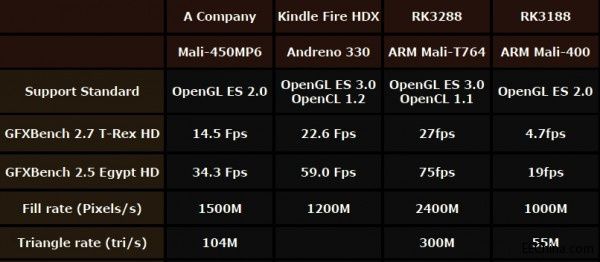

中國大廠接受嗎? 中國平板晶片霸主的瑞芯微CES炫功力,首發28nm製程(Glofo)的RK3288,是全球第一個四核ARM Cortex-A12內核、全球第一個支持最新超強Mali-T764 GPU以及全球第一個4K UHD硬解H.265的晶片。到頭來,A12頭香讓426搶了。現場還展示配套的LTE模組LM801(應是第三方晶片)。   以上之Cortex-A17為Rockchip誤植,實際應為A12!    |

|

|

|