引用:

|

作者weiter5494@2014-01-28, 02:19 PM #90

...在一片智機往中低端傾斜的浪潮中,Apple上季的ASP罕見逆勢上揚,季增10.4%至$637,僅年減$4。然iPhone在聖誕旺季的銷量自2012年的年增近1000萬支,降至2013年的年增300萬支。

堅持高價政策以穩定獲利是否便是犧牲iPhone銷量成長的代價?在一干增收減益的一線智機品牌中,Apple雖依舊獨占鰲頭,但疲態已現。 |

引用:

|

作者weiter5494@2014-04-08, 08:14 PM #115

符合上季法說會釋出的獲利將持續衰退的警示, Samsung季報預告其營益年減4.3%,營收與去年持平。

...53兆韓圜營收遜於市場預期,FacSet原先認為有54.7兆;營益部分則大致符合。

8.40兆 - FactSet

8.50兆 - Thomson Reuters I/B/E/S

8.35兆 - StarMine's SmartEstimate

...隨著Samsung連續第二季獲利走下坡,月底Apple的季報是否亦是同病相憐? |

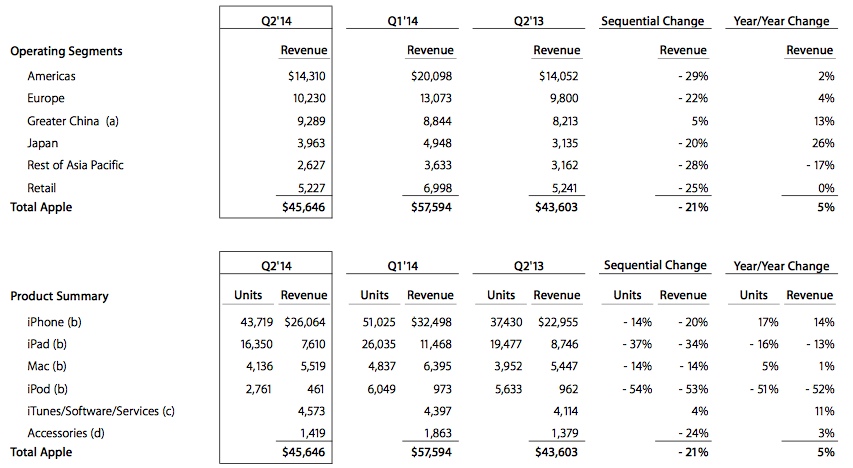

Apple公布1Q14財報如下。

營收:$456.46億,年增$20.43億(4.69%),超出財測的420~440億區間,也優於市場預測均值的$435億。

營益:$135.93億,年增$10.35億(8.24%)。

淨利:$102.23億,年增$6.76億(7.08%)。

毛利率:39.3%,年增1.8個百分點(4.8%)

39.6%優於Apple早先財測的37%~38%區間,亦為其近六季以來毛利率最高點,更海K市場預測均值的37.7%。

毛利增加顯示Apple在零組件成本與製造費用有所降低,除了關鍵IC NAND跌價外,與新興市場熱賣的舊機4S攤提結束也有高度關聯。再觀iPhone上季均價$596,年減$17,季減$41,創下歷年最高跌幅,若非高階降價,即是低階銷售占比提高。

When you look at the

$41 of decline, about half of that was driven by the fact we have continued to do very well in emerging markets with the 4S. There’s a lot of markets we’ve grown very strongly, in Latin America, Asia-Pacific, Eastern Europe. The rest was primarily as we move away from the quarter, we tend to have lower-capacity mix in our numbers.

Sales performance from the iPhone 5s, 5c and 4S were at all-time highs compared to their predecessors.

Driving a large portion of iPhone growth were developing markets. In particular, more than

85 percent of iPhone 4S and 69 percent of iPhone 5c buyers were new to the platform. China Mobile was especially helpful in the low end.

Greater China sales of the iPhone 4S hit an all time high in quarter two as the halo iPhone 5s helped attract new customers.

Both

India and Vietnam, doubled overall iPhone sales, while

Brazil, Poland, Turkey and others saw double-digit growth year-over-year.

- Luca Maestri, incoming CFO of Apple

得力於中移動通路,4S賣到最高點;而印、越兩地銷量翻番,巴、波、土等區域也有兩位數年增率成長。

BRIC countries (Brazil, Russia, India and China) clocked in with best-ever sales, illustrating the iPhone's growth potential in key developing regions.

We’ve seen our ability to attract new users to iPhone to be very significant in emerging market. We saw

new-to-iPhone numbers on iPhone 4S in the 80% level in certain large geos. This gives us confidence we can continue to grow. If we can

get them in on the entry iPhone, it gives them a great product at a great value and gets them into the ecosystem. The things you are seeing in the U.S. are not occurring in the other geos. Each country has its own cadence.

We sold

a very, very low single-digit percentage (of iPhone 4 units). Those sales had a minimal impact to results on the quarter.

- Tim Cook, CEO of Apple

US iPhone銷售成長

Cook解釋4S固然然助益iPhone在新興市場的銷售,但占整體約極低個位數比例,若以2%計,也有約90萬支。至於不到百萬支的低價iPhone,是否真能拉低$41整體ASP,值得細算。

舊機降價,以舊拉新的做法成功進軍新興市場,將益加鞏固Apple聚焦高階精品手機的信心,拒絕針對市場低價趨勢來開發專屬機款的想法。

iPhone熱銷爆冷門,同樣地,iPad弔詭衰退(1635萬台,季減37.2%,創最大季節性減幅,同時年減16.1%,也低於市場預測均值的1930萬台)也是讓專家跌破眼鏡。此際,iPad的ASP卻是『正成長』的,上季均價$465,年增$16,季增$25,未見促銷動機。雖然從報表數字來看,較高毛利的iPhone多賣了,佐以較低毛利的iPad少賣了,實際體現在Apple的獲利成長,但市場依舊譁然於iPad在仍處於擴張階段的平板市場的未來發展空間。

iPhone、iPad出貨年增率

We saw the decrease as

a nominal change, which equates to a 3 percent decline due to channel inventory fluctuations.

- Luca Maestri, incoming CFO of Apple

Analysts had forecast incorrectly. There were two factors behind this. In the same quarter a year-prior, Apple

increased iPad channel inventory, whereas in this quarter it was reduced. And secondly, Apple ended the first quarter, its main holiday season in 2012, with

a backlog of iPad mini, which was subsequently shipped during the second quarter just ended.

- Tim Cook, CEO of Apple

Apple解釋,因為通路大量補貨與2012年底大批iPad mini的未出訂單消化造成去年首季的出貨高基期,使市場高估了上季iPad銷量。言下之意,1600萬台是iPad的正常實力範圍?

IPad absolutely has been the fastest-growing product in Apple’s history. We’ve sold 210 million [units since inception.] It’s interesting to note that’s almost twice as many iPhones as we sold in a comparable time.

Cook依例自豪於自家產品,盛讚iPad成長迅速,甚於iPhone。不過接著一番弦外之音,暗喻iPad更聚焦在特定或垂直市場的滲透率,而非削價衝量,似乎回應了對目前低價平板擴張的看法。

The usage numbers are off the charts. Four times the Web traffic of all Android tablets combined. In consumer, if you look at the

U.S., we had 46% share. In

education, in U.S., we have a 95% share. In the enterprise market, we’re seeing virtually all,

98% of the Fortune 500, using iPad. And

91% of activations of tablets in enterprise are iPads. Many of those enterprises are

writing key proprietary apps that are essential for running those busiensses.

Just like in education what we have to do is

focus on penetration. In terms of having people begin the process, writing apps, we’re doing a pretty good job of that. What drives us is the

next iPad, the things that are in the pipeline that we can add to it.

Apple’s revenue growth in Japan driven by iPhone sales - THE BRIDGE

營收細目,iPhone占比47.1%、iPad占比19.9%。

Unit sales of the Mac were up by “

double digits” in China, while software and services

more than doubled. We literally did well in every single area in China.

It wasn’t just because we were able to come to an agreement with the world’s largest carrier. The improvement in China reached across our entire range of businesses, with

Mac sales increased by more than 10% and App Store revenue doubled. China was exceptional.

論成長動能,市場面,Apple前兩大市場美、歐已現疲態,年增不及5%,直營零售店無成長,亞太區域衰退,僅第三大市場中國與日本撐起大旗;產品面,iPhone一夫當關,iPad衰退,Mac持平,基本不受季節性因素影響的iTunes服務雖達低兩位數成長,亦在減速狀態(1Q13年增率為26%)。

面對強強聯手的Amazon與HBO,Cook對未來的內容大戰仍無懼色,信心滿滿。

Content sold for AppleTV had topped a

billion dollars last year. We now sold

20 million units of AppleTV. We believe AppleTV’s content “compares very favorably” with Amazon’s “Prime”, who just announced with HBO a content deal for streaming video.

Apple手頭現金上季結餘約$1510億,季減$80億。即使應對擴大規模的庫藏股回購計畫,Apple擬發債籌資支付,持續迴避將海外現金匯回本土所產生的高額稅金。

Apple reported holding roughly billion in cash and securities at the end of March, down from about $159 billion three months earlier. In early February, the company said it bought back about $14 billion in shares after its stock fell on disappointing quarterly earnings. The company said it would fund the stepped-up capital-return program by issuing debt, rather than repatriating profits from abroad that would be taxed at a high rate in the U.S.

按例,Apple仍提供相對保守的本季財測。由於明顯的季節性因素,缺乏新機催化的本季注定是Apple業績的谷底,也讓市場備加關注充滿期望的第三季。

Apple's guidance for its fiscal 2014 third quarter:

• revenue between $36~$38 billion

• gross margin between 37%~38%

• operating expenses between $4.4~$4.5 billion

• other income/(expense) of $200 million

• tax rate of 26.1%