意料之外,情理之中?

皇者Apple雖然增收增益,勁道卻有限。看來高階市場飽和,勢不可擋。

神器5s加持,iPhone整體實際銷量僅年增320萬支,來到5100萬支。

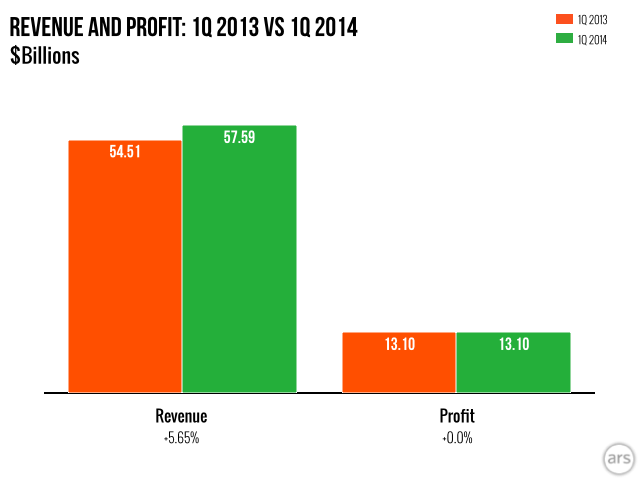

Apple上季財報,576億鎂營收優於預期;營益小增2.5億鎂至174.63億鎂;淨利持平(130.72億 vs 130.78億);現金部位再增加120億鎂。

• iPhone units: 51 million versus 54.7 million expected by sell-side analysts and 56-57 million expected by buy-side analysts

• iPad units: 26 million versus 25 million expected by sell-side analysts and 24-25 million expected by buy-side analysts

• iPod units: 6 million versus 8 million expected by sell-side analysts

• Mac units: 4.8 million versus 4.6 million expected by buy-side analysts

• Revenue: $57.6 billion versus $57.43 billion expected by sell-side and $58 billion expected by buy-side analysts

• EPS: $14.50 versus $14.08 expected by sell-side analysts and $14.35 expected by buy-side analysts

• iPhone ASP: $637, which is way up, sequentially. Last quarter, iPhone ASP was $577.

• iPad ASP: $441, about the same as last quarter when it was $439

• Cash: $159 billion, up from $147 billion last quarter.

• March quarter revenue: $42-$44 billion versus $45.74 billion expected by sell-side analysts

iPhone 5s光環褪色,期待明天會更好。

The overriding theme from tonight's results will be an increased debate about iPhone unit growth going into the iPhone 6 product cycle (likely Fall 2014). More specifically, we believe the debate will be centered around the trade-off between higher ASPs (exceeded expectations in Dec-13) vs lower unit growth (lower than expectations at 7% in Dec-13). The second key topic will likely center on clarity around new products and Apple's growth outlook beyond 2014. We remain buyers of AAPL as we enter the iPhone 6 cycle and the potential for new products in the back half of 2014.

- Gene Munster@Piper Jaffray