|

PCDVD數位科技討論區

(https://www.pcdvd.com.tw/index.php)

- 七嘴八舌異言堂

(https://www.pcdvd.com.tw/forumdisplay.php?f=12)

- - 單晶起兮台積揚 半導群雄各圖強

(https://www.pcdvd.com.tw/showthread.php?t=1032353)

|

|---|

我覺得平板與電腦的整合還是在輸入端吧

例如我辦公桌上有一個連線到所有裝置的插糟,可以讓我用鍵盤,列印紙張 我要出外時就直接拔掉平板去拜訪客戶 不過依現在的技術,平板可以用投影鍵盤打字,要列印傳輪資料也可以用無線/藍芽 照理來說平板早該取代電腦了,我想問題還是在於大家辦公時大螢幕比較爽吧 所以還是等平板能投影大畫面時才能取代電腦? |

引用:

Ya~~:like: W大您竟然有來這裡 之前一直拜讀您在數字站的文章 後來您被惡搞之後 很怕看不到您精闢的產業分析了 :cry: |

承蒙不棄!希望在此依然有同好,繼續訊息分享。

|

引用:

在數字戰被惡搞 :shock: 是不是說太多真話的關係 :confused: |

引用:

投影鍵盤.........還沒普及吧 |

引用:

分析的很好, 但是我說的"有些公司" 並不是指 Intel :ase 根據你的數據, 台積電 2%營收大約美金 100M, 30億台幣 30億台幣可是很多企業突破不了的天險 :flash: |

引用:

所以我在想平板要取代電腦,輸入工具卡死,輸出螢幕卡死,應該就是無法取代電腦的主因 如果今天平板能省掉鍵盤的空間,投影大畫面開excel編輯文字無壓力,那應該就能取代電腦了吧? |

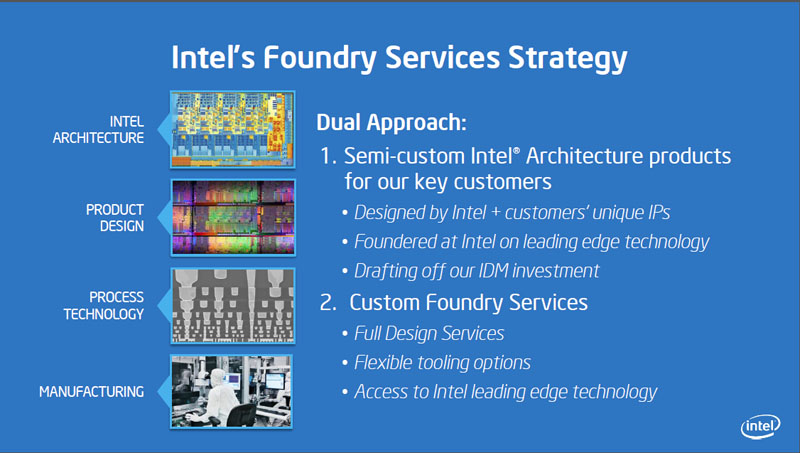

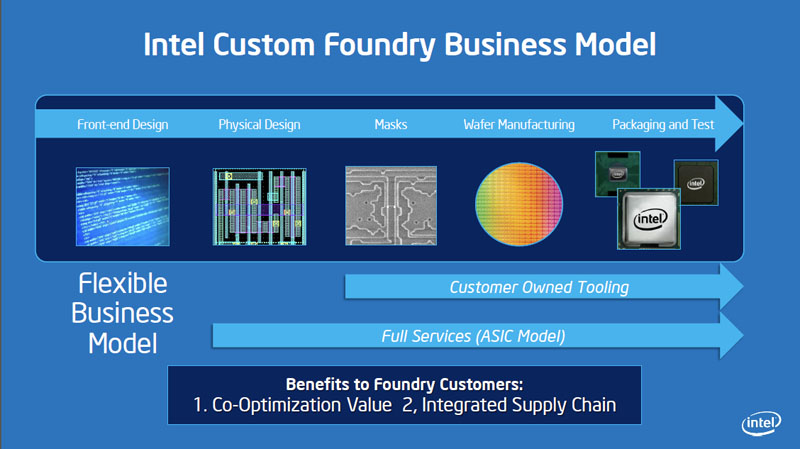

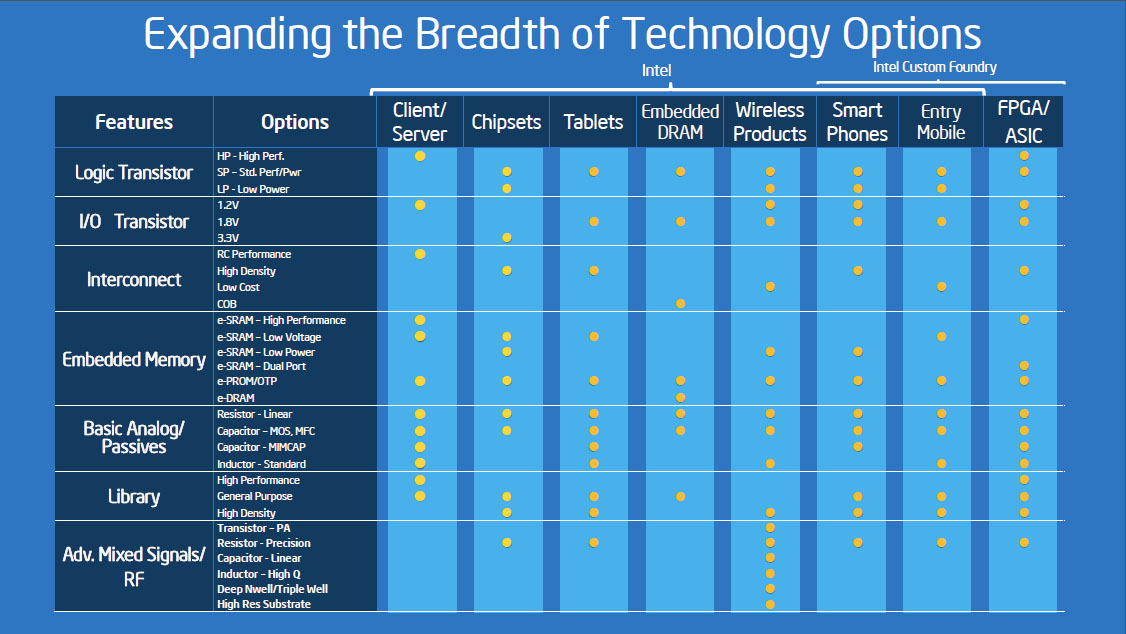

Intel早已對ARM陣營的foundry業務牛刀小試。Altera的64位元ARM晶片採intel 14nm製程,將於2014年底完成,並於2015年開始量產。Netronome的stream processor由Intel代工,也是ARM架構。    Intel plans to continue to leverage its manufacturing leadership and open its foundry business to a broader list of companies that will be able to utilize Intel’s IDM advantage. The foundry offering consists of a dual approach which can offer semi-custom IA products for key customers or provide custom foundry services including full design services. Historically, Intel has said that it would not enable competitors to IA with its foundry business […] We continue to view Intel’s longer-term prospects positively. - Ruben Roy with Mizuho Securities USA Intel開放foundry業務,向ARM陣營的基頻晶片和手機應用處理器對手招手,僅是其一廂情願,難以成局,因為主要競爭對手大概沒人願意和強敵分享晶片設計核心細節。再者,foundry業界尚有其他選項,除非Samsung或GloFo無法於2015年量產14nm。而TSMC的20nm製程在2014年將囊括所有主要的行動通訊大咖,稍早傳聞Apple將部分A8處理器轉單Intel英特爾的可能性極低。 - Merril Lynch Intel和Apple、Qualcomm、nVidia間存在某種程度的競爭衝突,代工訂單取得有難度。 - Macquarie  Most importantly, Intel appears to be extending its manufacturing lead over TSMC, which we think translates to share gains in tablets and smartphones. Intel was driving transistor cost down faster than it has before, while TSMC stalls on the transistor cost curve. We quantified Intel’s die size advantage over TSMC to be 35% on 14nm and 45% on 10nm. We expect this to translate into share gains in tablets and smartphones. - Mark Lipacis with Jefferies & Co. Intel believes it will have ~35% advantage in area scaling on 14nm FF (vs. 16nm TSMC) and 45% on 10nm (vs. TSMC). Intel has all of the tools to succeed, and those tools appear to be even better than ever in next 2–4 years. - Doug Freedman at RBC Capital Markets Intel believes that it currently has a 3.5 year advantage over TSMC and that it is currently driving cost down faster than Moore’s Law. Overall, we believe that Intel’s manufacturing edge could make a significant difference in the future competition with vendors that use TSMC and Samsung. - Daniel Amir with Lazard Capital Markets |

引用:

沒搞錯吧?英特爾在技術上超前台積三年多, 這有點扯喔. |

引用:

寒狗當年玩LCD面板不也是對呆丸猛下單... 廠商為擴廠增加產能 , 等新廠落成 , 寒狗狼也抽單啦... :shock: :shock: :shock: |

| 所有的時間均為GMT +8。 現在的時間是06:43 AM. |

vBulletin Version 3.0.1

powered_by_vbulletin 2025。